$200 Cash Advance

2025/12/15

Need a $200 Cash Advance? Here Are Your Best Instant Options

Life happens. Whether it’s a flat tire, an unexpected medical bill, or just running short on groceries before Friday, sometimes you just need a small buffer to bridge the gap.

If you are looking for a $200 cash advance, you likely need it fast, and you might be worried about your credit score. The good news? The lending landscape has changed. You no longer have to rely solely on predatory payday lenders. From modern apps to installment loans, you have options.

Here is your complete guide to getting a $200 loan instantly, how to choose the right type, and what to watch out for.

Who Is This Loan For? (Target Customer)

A $200 cash advance is a specific financial tool designed for short-term needs. It is not a long-term solution for debt. This loan is best for you if:

- You are employed: You have a steady paycheck coming in within the next 2 weeks.

- You have Bad Credit or No Credit: Your FICO score is below 600, or you have no credit history at all.

- You have an immediate emergency: You need to pay a bill today to avoid a late fee that is more expensive than the loan fee itself.

Option 1: Cash Advance Apps (The Best Way)

If you need a small amount like $200, cash advance apps are currently the most popular and affordable method. Unlike traditional loans, these apps usually charge 0% interest. Instead, they ask for a small monthly subscription fee or an optional "tip."

Here are the top contenders for a $200 advance:

1. Dave

Dave is famous for its "ExtraCash" feature. You can get an advance of up to $500 (though new users often start lower, around $200 is common if you have steady income).

- Cost: $1/month membership + optional tips.

- Credit Check: None.

- Speed: Instant transfer available for a small fee.

2. EarnIn

EarnIn works differently—it lets you access the money you’ve already earned but haven’t been paid for yet. You can withdraw up to $100/day or even more depending on your pay cycle.

- Cost: No fees (tipping is optional).

- Requirement: You must have a physical workplace or an electronic timesheet.

3. Chime (SpotMe)

If you bank with Chime, their "SpotMe" feature acts as a fee-free overdraft. It allows you to overdraft your debit card up to $200 without penalty.

- Cost: Free.

- Requirement: Requires a Chime checking account with direct deposit history.

Option 2: Payday Loans (The High-Risk Way)

When you search for "whatever loans" or "$200 loan bad credit," you will often find Payday Loans.

A payday loan is a short-term, high-interest loan due on your next payday. While they are easy to get, they are expensive.

- Pros: High approval rate (they rarely check credit), cash is usually available within 1 hour or 24 hours.

- Cons: APRs can hit 400% or more. A $200 loan might require you to pay back $230 or $250 just two weeks later.

- Verdict: Use this only as a last resort. If you miss a payment, the fees can spiral into a debt trap.

Option 3: Installment Loans vs. Personal Loans

You might be wondering, "Can I just go to a bank for $200?"

The short answer is no. Most traditional banks and Personal Loans have a minimum borrowing amount, usually starting at $500, $1,000, or even $2,000. It is very difficult to find a traditional personal loan for just $200.

However, some online lenders offer Small Installment Loans.

- How it works: You borrow $200-$500 and pay it back over 3 to 6 months rather than all at once on your next payday.

- Benefit: The payments are smaller and more manageable.

- Risk: Interest rates are still high for bad credit borrowers, often between 36% and 100% APR.

Comparison: Which Loan is Right for You?

| Feature | Cash Advance Apps | Payday Loans | Installment Loans |

|---|---|---|---|

| Loan Amount | $50 - $500 | $100 - $1,000 | $500 - $5,000 |

| Credit Check | None | Rare | Yes (Soft or Hard) |

| Cost | Tips / Monthly Fee | High Fees ($15-$30 per $100) | Interest (APR) |

| Repayment | Next Paycheck | Next Paycheck | Monthly Payments |

| Best For | $200 Needs | Last Resort | Larger Expenses |

Direct Lenders vs. Loan Brokers

It is crucial to understand the difference when applying online:

- Direct Lenders: You apply with them, they fund your money, and you pay them back. Your data stays with them. (e.g., Check 'n Go, Ace Cash Express).

- Loan Brokers (Connection Services): These websites do not lend money. They take your data and sell it to dozens of lenders. This often leads to spam calls and emails. Always look for "Direct Lender" on the site footer.

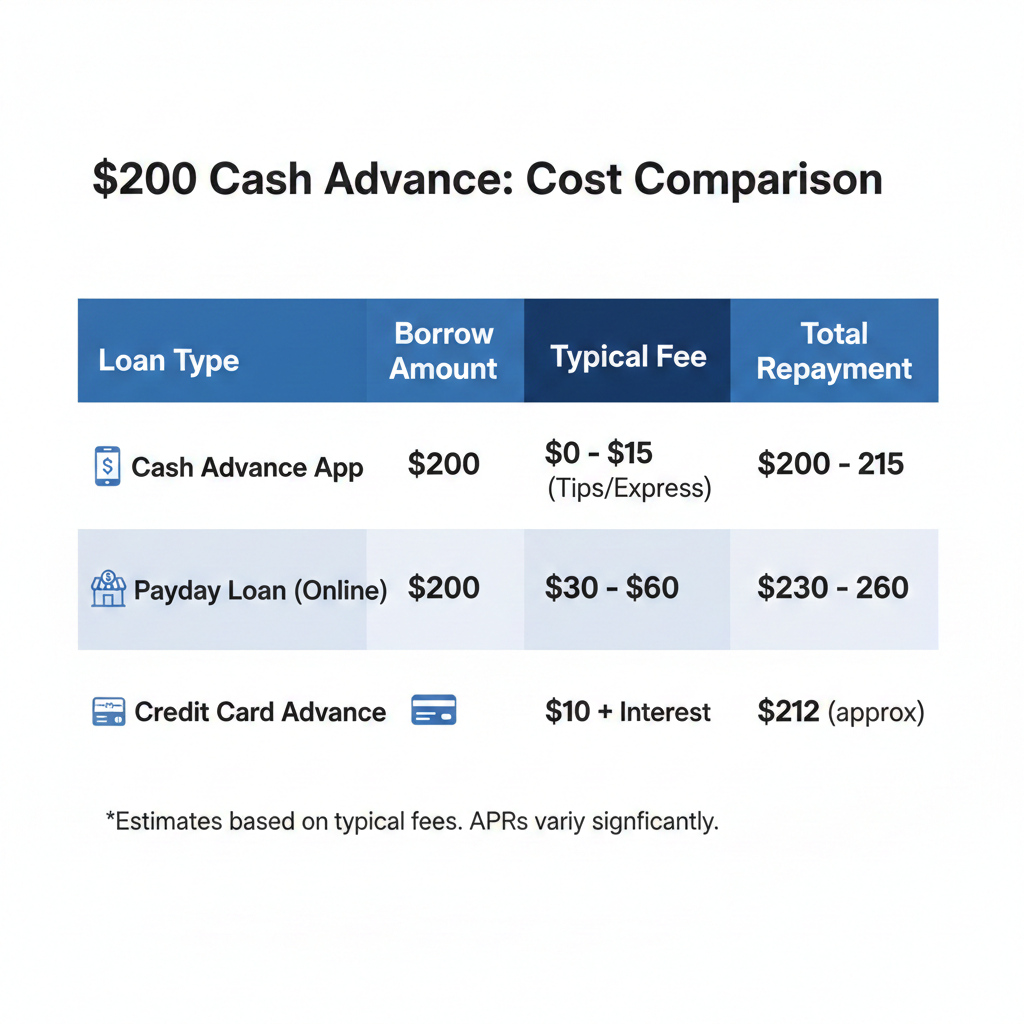

Rates, Fees & APR: What Does it Really Cost?

Borrowing $200 isn't free. Here is the breakdown of what you will actually pay back depending on the method you choose.

| Loan Type | Typical Fee | Est. APR | Total Repayment |

|---|---|---|---|

| Cash Advance App | $0 - $15 (Tips/Express Fee) | 0% - 100%* | $200 - $215 |

| Credit Card Cash Advance | $10 Fee + Interest | 25% - 30% | $212 (approximate) |

| Payday Loan (Online) | $30 - $60 | 400% - 660% | $230 - $260 |

| Bank Overdraft | $35 (Per transaction) | N/A | $235 |

Note on APR: While apps claim 0% interest, if you pay a $5 express fee on a $100 loan for 7 days, the effective APR is actually quite high mathematically. However, it is still much cheaper than a payday loan.

How to Get a $200 Loan with Bad Credit

If your credit score is below 600, you can still get approved. Lenders for small amounts care more about your income than your credit history.

To increase your chances of approval:

- 1. Have a steady checking account: Lenders want to see regular deposits (income) going into an account that has been open for at least 3 months.

- 2. Avoid overdrafts: If your bank account is currently negative, many apps like Dave or EarnIn will deny the advance.

- 3. Apply early: Instant transfers often cost extra. If you can wait 1-3 days, you can usually get the money for free.

Which States Allow These Loans?

Not everyone can borrow $200 legally. State laws vary significantly to protect consumers.

States that Ban or Strictly Limit Payday Loans:

If you live in these states, you will likely not find a legal online payday lender. You should use Cash Advance Apps instead, as they operate under different legal structures (tips/subscriptions).

- Arizona, Arkansas, Connecticut, Georgia, Maryland, Massachusetts, New Jersey, New York, North Carolina, Pennsylvania, Vermont, West Virginia, and Washington D.C.

States Where Payday Loans are Common:

- Texas, California, Nevada, Missouri, Wisconsin, and others.

- Note: In these states, verify the lender has a state license to operate.

Conclusion: How to Get Your $200 Today

If you need cash right now, follow this hierarchy to save money:

- 1. Check your existing banking app: Does your bank offer a grace period or small loan feature (like Chime SpotMe or Wells Fargo Flex Loan)?

- 2. Try a Cash Advance App: Download Dave or EarnIn. This is the cheapest way to borrow $200.

- 3. Last Resort - Direct Payday Lender: If you must use a payday loan, ensure it is a Direct Lender to protect your personal data, and have a plan to pay it off in full on your next payday.

Frequently Asked Questions (FAQ)

1. How can I get a $200 cash advance instantly?

The fastest way to get $200 instantly is through cash advance apps like Dave, EarnIn, or MoneyLion. These apps can often transfer funds to your debit card within minutes for a small "express fee" (usually $3.99–$8.99). If you do not qualify for apps, some online payday lenders offer same-day funding, but they charge much higher interest rates.

2. Can I get a $200 loan with bad credit?

Yes. Most cash advance apps and payday lenders do not check your FICO credit score. Instead, they approve you based on your banking history. If you have a checking account with regular direct deposits (income), you can typically qualify regardless of your credit score.

3. What apps let you borrow $200?

Several apps offer advances of $200 or more. Dave offers up to $500, EarnIn allows up to $100 per day (often exceeding $200 per pay period), and Chime SpotMe allows fee-free overdrafts up to $200 for eligible members.

4. How much does a $200 payday loan cost?

A traditional $200 payday loan is expensive. Lenders typically charge $15 to $30 for every $100 borrowed. This means you will likely pay back between **$230 and $260** for a single $200 loan. In contrast, cash advance apps may only cost you a small monthly subscription (e.g., $1) and an optional tip.

5. Are there direct lenders for $200 loans?

Yes. There are direct payday lenders who fund the loan themselves rather than selling your information to other companies. However, for such a small amount ($200), it is often safer and cheaper to use a cash advance app or a "Buy Now, Pay Later" service before turning to a high-interest direct payday lender.

The Bottom Line

If you need a $200 cash advance, avoid the payday loan store if possible. Download an app like Dave, Brigit, or MoneyLion first. They are cheaper, safer, and designed to help you bridge the gap to payday without trapping you in debt.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Loan terms and interest rates vary by lender and location. Always read the fine print before borrowing.